Attention to corporate sustainability has significantly intensified. According to the International Federation of Accountants (IFAC), in the three-year period 2019-2021, the trend of reporting by organizations is increasing: about 95% of the companies analyzed prepare a sustainability statement, with 86% of the sample choosing to adopt more than one standard, favoring the GRI ones (used by 74% of companies).

To standardize corporate sustainability communications and prevent the possibility of spreading false numbers, the European Union spurred the creation of ESRS standards for more transparent and truthful sustainability reporting. Let’s find out what they are, which companies will need to adopt them, and from when.

What are ESRS? The role of EFRAG

ESRS standards are a product of EFRAG, an acronym for European Financial Reporting Advisory Group. This organization, based in Brussels, was established in 2001 with the aim of providing technical advice on the adoption and application of international accounting standards in the European Union.

With the issuance of the CSRD directive by the European Union, the adoption of European standards for reporting becomes mandatory. EFRAG has been tasked with creating a draft of EU sustainability reporting standards.

On November 22, 2022, after a public consultation period, EFRAG proposed to the European Commission a first package of twelve ESRS standards.

ESRS: How are EFRAG standards structured?

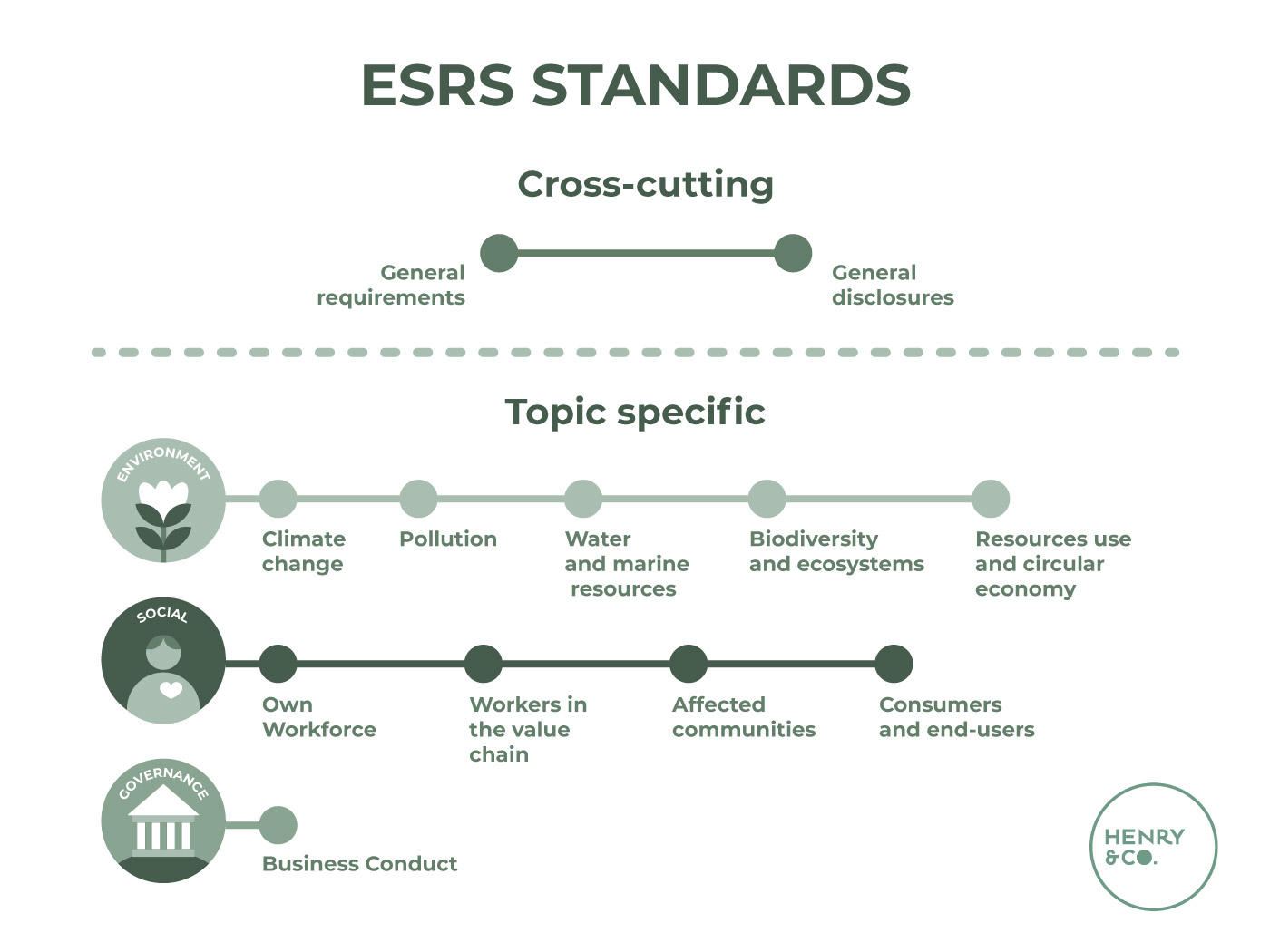

The 12 sections of ESRS are divided into two macro areas:

- 2 cross-cutting standards, which are standards not specific to a single sustainability theme, but applicable across all reporting fields;

- 10 topic-specific cross-sector standards, which are requirements covering the 3 ESG areas: Environment, Social, and Governance.

The three ESG areas include:

- five environmental standards (“Climate change”, “Pollution”, “Water and marine resources”, “Biodiversity and ecosystems”, “Resources use and circular economy”);

- four social standards (“Own Workforce”, “Workers in the value chain”, “Affected communities”, “Consumers and end-users”);

- one governance standard (“Business Conduct”).

Once approved by the Council and the European Parliament, the CSRD directive provides that EFRAG will continue its work with an additional area of “sector-specific standards”, i.e. requirements applicable depending on the sector(s), and specific standards for SMEs.

How do they integrate with other regulations to simplify adoption of the standards?

In drafting the ESRS proposals, related European regulations and international sustainability reporting initiatives were taken into account.

The standards:

- incorporate the PAI indicators (Principal Adverse Impacts);

- have been coordinated with the Taxonomy Regulation to avoid additional obligations for companies beyond those already required;

- have been coordinated with the Capital Requirement Regulation for Banks and Financial Institutions;

- have been coordinated with the main global reporting standards (Protocol, GRI, UN SDGs, ISO 26000, etc.).

What are the new principles introduced by the ESRS standards?

The new standards bring several innovations. Some key provisions include:

- Double materiality: According to the cross-cutting standards, organizations must disclose all “material” information about impacts, risks, and opportunities identified through the “impact materiality assessment.” The company’s financial risks and opportunities related to sustainability are defined through a “financial materiality assessment.” In short, companies must provide information on the impact of their activities on people and the environment (an inside-out approach), and how sustainability factors affect them and their results (an outside-in approach).

- Reporting on a broader range of topics: ESRS require reporting on material impacts, risks, and opportunities on a wide range of environmental, social, and governance topics. Following a materiality assessment, companies must ensure they have the data, processes, and expertise to report on topics that may be new to them, such as biodiversity or circular economy.

- Governance: Companies must clearly define their governance on how they address sustainability issues, including how key sustainability performance indicators (KPIs) impact executive compensation.

- Reporting related to the annual financial statement: Companies falling under the scope will prepare a sustainability statement that includes the information required by ESRS as part of their management report, published simultaneously with the annual financial statements.

- Reporting of impacts, risks, and opportunities along the value chain: Companies must identify and report impacts, risks, and opportunities along their entire value chain. They need to understand how this requirement will affect their reporting and data collection, even though the amount of required value chain data has been reduced compared to the initial drafts, and there are gradual implementation allowances.

- Reporting of policies, action plans, and targets: Companies must be ready to provide detailed information on their policies, action plans, and targets across all relevant topics. Although the standards themselves do not require companies to set new targets or implement new policies, they will bring more visibility and scrutiny to their plans. Undertaking an implementation project is therefore an opportunity to identify and address areas where companies may be less advanced than they would like.

When do the ESRS standards come into effect?

The obligation to report in accordance with ESRS establishes:

- from June 30, 2023 the cross-cutting standards and the specific standards on Environment, Social, and Governance come into effect;

- from June 30, 2024 the use of sector-specific standards, for SMEs, and for companies exporting to Europe.

For whom is the sustainability report mandatory?

The introduction of the CSRD significantly expands the scope of companies involved in drafting the sustainability report compared to the current NFRD (Non-Financial Reporting Directive), so much so that companies in the EU preparing the report will increase from 11,700 to about 49,000, including 4,000 in Italy alone.

ESGR standards are addressed to three types of companies:

1) Large unlisted companies that have exceeded at least two of the following criteria:

- 250 employees;

- 20 million euros in assets;

- 40 million euros in net revenue.

2) Small and medium-sized listed enterprises, including small credit institutions and insurance companies dependent on a group.

3) Enterprises and branches with a non-EU parent company, where the parent company has generated over €150 million in net revenue in the EU for each of the last two consecutive years, and at least one of the following:

- a subsidiary meets the size requirements of the CSRD;

- a branch generated more than €40 million in net revenues in the previous financial year.

What are the timelines for applying ESGR European standards?

The regulation mandates:

- from January 1, 2024 companies that already have non-financial reporting obligations today, i.e. listed companies with more than 500 employees and of significant public interest, will be required to report (reporting in 2025 on the 2024 year);

- from January 1, 2025, the obligation will extend to large unlisted companies (reporting in 2026 on 2025);

- from January 1, 2026 for listed SMEs, small and non-complex credit institutions, and captive insurance companies (reporting in 2027 on 2026).

From January 1, 2028, it will also be mandatory for non-EU companies operating in Europe.

In summary

The EFRAG standards for sustainability reporting are a first step forward by the European Union towards transparent reporting of environmental, social, and governance impacts.

However, in order to report on sustainability, one must know what type of information to report and how to measure it. With HENRY & CO., you can create a tailored and certified report to capture a snapshot of the environmental impact of your business. Contact us to find out more.